How to cancel payment through PayPal is an active user of the platform might inexplicably need to perform. Since PayPal offers individuals and businesses the opportunity to make and receive payments from family, friends, and customers and often prone to errors. Therefore, knowing how to cancel payment through PayPal becomes essential.

PayPal is also used to transact business with suppliers, vendors, as well as send payments for essential services. The platform is certainly a delightful choice for people looking to utilize a secure, easy-to-use platform either for personal or business purposes. It’s quite popular among businesses with an online presence as well as international payment receivers.

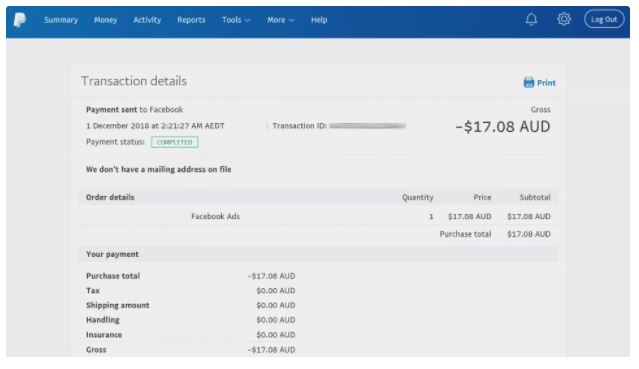

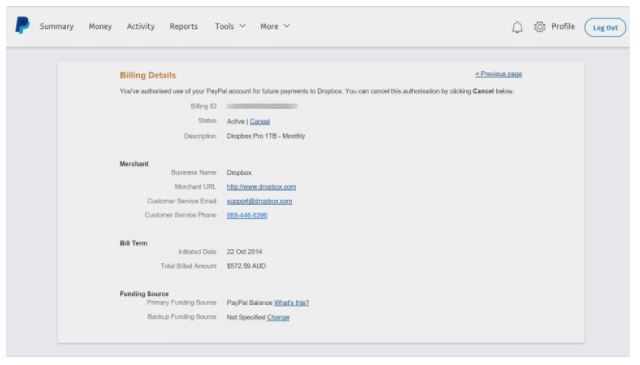

This means the platform handles large amounts of transactions on behalf of clients. It, therefore, leaves room for users to cancel payments they’ve made. Users can cancel recurring or subscription payments as well as one-time payment that is yet to be claimed by the recipient.

This article, to walk you through the entire process of canceling a payment through PayPal without stress. We will walk you through the scenarios possible for cancellation as well as the procedures involved.

What is PayPal?

PayPal is a handy tool for sending and receiving payments online from both domestic and international sources. Friends, family, customers as well as businesses can easily utilize the platform to get funds across to any part of the world with ease. The platform is beneficial in many aspects to its numerous users and some of its benefits are as follows:

Easy to use

One factor that endears PayPal to a lot of its teeming users is the fact that the platform is easy to use regardless of tech skills. The platform has an easy-to-use yet simple outlook. Its organized interface ensures that it’s simple to navigate through.

For further simplicity, the platform has a mobile app that is compatible with iOS and Android mobile devices as well as tablets. The platform also has a bill-splitting feature called Money Pool. This allows users to accept funds from multiple friends to offset shared expenses or donate to a cause.

Popular payment platform

PayPal is a popular, widely-used, and accepted personal and finance app. Its share popularity means it’s easy to transact business as chances are that the receiver has a PayPal account. Also, the platform supports both domestic and international payments.

Popular stores such as eBay, Apple, Amazon, Target, Overstock, and The Home Depot all accept payment via PayPal. Another plus side of using PayPal is that users also get to store their store loyalty cards within the app. This means they can get rewarded for shopping on their favorite platforms.

If you are thinking of holding a fundraiser, think of PayPal. The platform makes it easy to organize and receive donations for whatever legal purpose. It doesn’t charge any fee for using the ‘Giving Fund’ page feature to raise money.

Supports International Money Transfers

PayPal is available in over 200 countries all over the world making the need to send money abroad easy. Just ensure you make adequate provisions for the charges attached to such transactions.

Users can also hold multiple currencies in a single PayPal account, send and receive payments in other currencies as well as convert their PayPal balance to another currency. This flexibility allows for seamless international transactions with been able to leverage the best deals available. Irrespective of your current location and currency!

Safe platform

PayPal is known for the safety and security of transactions made on its platform either the web or the app. The platform doesn’t share its user’s financial data when they make purchases or transfer funds to friends and families.

Additionally, its protection policies expressly cover its users when they are buying or selling products online. Should a buyer not receive a product or service purchased via PayPal, the platform gets you your money back.

Multiple payment methods

When we said the platform was easy to use, we didn’t mention the funding payment method. The PayPal platform allows users to fund their transactions online through various means.

So a user can decide to use any of the following such as bank account, debit card, credit card, or PayPal balance. Whichever method is convenient for the user is available and they are not restricted to one way. The only catch here is that some methods such as credit cards have charge fees associated with them.

How to cancel payment through PayPal: Why?

An individual can choose to cancel payment through PayPal for a number of reasons. Irrespective of whether such payment is a recurring and one-time payment, it is possible to cancel it. On how to cancel payment through PayPal, a user can choose to because of any of the following reasons:

- The content provided by the payment is not what they were expecting. It is easy for users to get lost in the myriad of information world that we live in today. When this happens, a user feels the need to cancel such a payment.

- A user can cancel payment through PayPal if they are not seeing value for the money paid. If the services or product paid for is subpar, they can choose to cancel.

- Ultimately users cancel payment through PayPal if and when they find themselves in a declining financial situation. This effectively makes it difficult to keep up with the payment obligations and as such, they decide to cancel.

- If a user is changing his or her location, chances are they will cancel any payment. This becomes necessary if the service is not been offered in the location they are heading to.

- No doubt, the level of competition is increasing daily. Newer platforms are looking for customers and are always eager to churn out impressive deals. Most times, they refer to lowering the price tag to attract customers. A user can decide to cancel the payment and move to the more favorable one.

How to cancel payment through PayPal

When it comes to how to cancel payment through PayPal, the task is not complex and easy to accomplish. Simply follow the steps below to effect the cancelation and have the payment returned to your account.

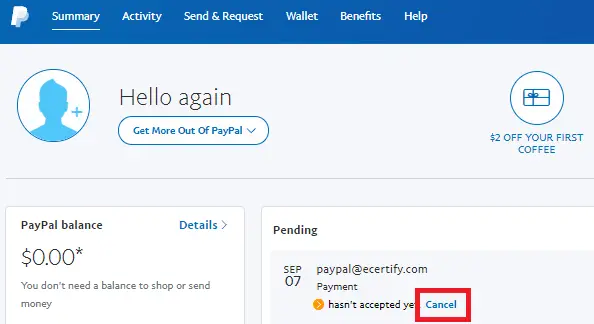

- Log in to your ‘PayPal’ account and click on the ‘Activities’ button.

- A list of all the recent transactions is displayed. A user has to then navigate to the payment he or she wishes to cancel using email, name, or other means.

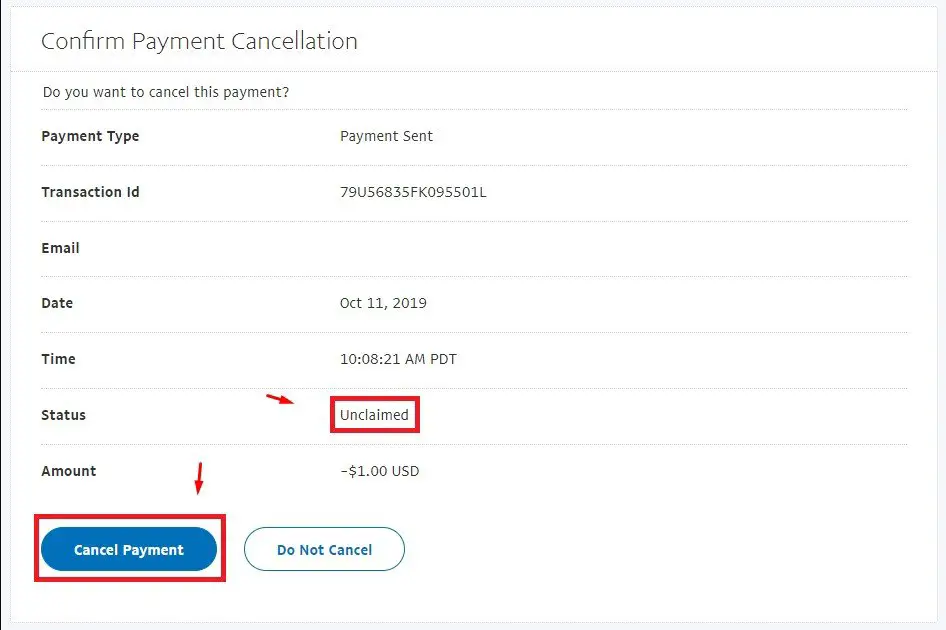

- Upon locating the payment, check if it’s unclaimed or still a pending transaction. You can do this via the ‘Actions column’. If the payment can be canceled, a ‘Cancel’ button will be displayed just below it. If the cancel option is not displayed, that means that the payment has been completed. The user will have to request a refund from the account holder.

- To proceed to cancel an unclaimed transaction, simply click the ‘Cancel’ button.

- You will be prompted to confirm the cancellation of the payment before continuing. At this point, a user can select the ‘Do Not Cancel’ option if they change their mind to go through with the payment. To cancel the payment, just click on ‘Cancel Payment’ to proceed.

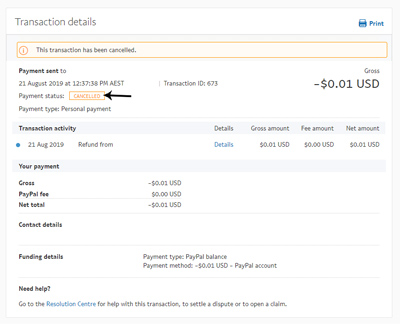

- Upon successful cancellation, the user is notified in the next dialog box that appears.

Immediately after a user successfully cancels a payment through PayPal, refunds are made into the user’s PayPal account. This is regardless of the mode of the original payment; either via bank funds or PayPal funds. Although there can sometimes be a delay the return of funds shouldn’t exceed four working days.

Pros of using PayPal

- PayPal is one of the most trusted third-party payment platforms by users all around the world. This effectively makes it one of the most popular ways to make a payment online.

- The platform has predictable pricing with flat rates to suit the individual budgets as well as various pricing plans available.

- It supports selling via subscriptions and recurring payments with lots of different currencies for international transactions

- Great developer tools for integrations and growth as well as extensive integrations with numerous eCommerce tools and platforms.

- The platform can be used as an all-in-one payment system which is ideal for low volume merchants who don’t take too many payments.

- Compatible with many mobile device platforms as well as accounting and financial tools.

- PayPal also provides hardware and card readers for its users

- For businesses, the option for borrowing money and capital is a welcome addition endearing the platform to many

Cons of using PayPal

- PayPal users often complain about the platform’s lack of consistent customer support.

- When you transfer money from your PayPal account to your bank account, you have two options: A free transfer; which often takes one to five business days or a paid instant transfer. The paid transfer is often processed in one business day, but there’s no guarantee.

- PayPal does set limits for unverified users. Limits are dependent on currencies but generally in the range of $10,000 in one transaction, with a cap of $60,000.

- PayPal is a popular platform and it’s often targeted by phishing scams. Unsuspecting users can fall prey to these scams when they receive and open fake emails that contain phishing links. Be aware of this when opening any email or PayPal link.

- Not suitable for higher-risk industries and lots of users have mentioned a sudden shut down of their account.

Conclusion

PayPal offers a flexible way of making both domestic and international transactions online without stress. The platform is fast, stable, and reliable and has been around for years, so they have experience in the field of handling third-party payments.

PayPal is quite popular among merchant sites as well as personal users. Should a user decide to want to cancel a payment transaction for whatever reason, the platform offers ample time to take such action. It should be noted that a completed transaction can’t be canceled directly from PayPal. In such instances, seeking a refund is best achieved by directly appealing to the receiver of such payment. In some cases contacting the PayPal Resolution Center could be of help.

To cancel pending or recurring payments on the platform is very easy. Simply follow the guides provided above to help you achieve this.

Note: please keep in mind that if you cancel a PayPal payment made with a credit card; it can take up to 30 days to get refunds to your credit card account. This means the processing of refunds is not immediate for canceling payments via credit card.