PayPal is arguably the most popular online payment platform and oftentimes, the need for a user to cancel pending PayPal payment can arise. Should an error or change of heart occur after which payment has been sent, users might probably wonder; if it is possible to cancel pending PayPal payment.

PayPal is no doubt an awesome choice for anyone looking to utilize a secure, easy-to-use platform either for personal or business purposes. It’s also quite popular among businesses with online presence as well as international payment receivers. Since it handles voluminous transactions, the platform leaves room for its users to cancel pending payment they’ve made. Users have the option to cancel a pending payment with an “unclaimed” status.

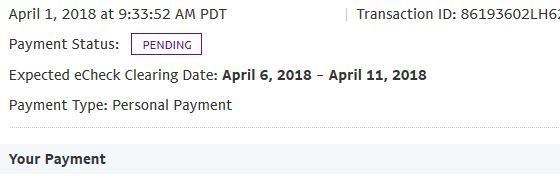

Note: To be able to effectively cancel pending PayPal payment, the transaction must be in “Pending” or “Unclaimed” status.

In this article, I, Daniel Umeh is going to examine in detail, how to cancel pending PayPal payment in less than 2 minutes.

Why use PayPal?

PayPal comes in handy when sending and receiving payments online from both domestic and international sources. Your friends, family, clients, and customers can easily leverage the platform to get funds across to you with ease. The platform possesses numerous benefits for its users and we will consider a few of these:

Ease of use

A major benefit that endears PayPal to its teeming users is the fact that the platform is easy to use regardless of tech skills. The platform has an easy-to-use yet simple outlook. Its organized interface ensures that it’s simple to navigate through.

For further simplicity, the platform has a mobile app that is compatible with iOS and Android mobile devices as well as tablets. The platform also has a bill-splitting feature called Money Pool. This allows users to accept funds from multiple friends to offset shared expenses or donate to a cause.

Popular payment platform

PayPal is a popular, widely-used, and accepted personal and finance app. Its share popularity means it’s easy to transact business as chances are that the receiver has a PayPal account. Also, the platform supports both domestic and international payments.

Popular stores such as eBay, Apple, Amazon, Target, Overstock, and The Home Depot all accept payment via PayPal. Another plus side of using PayPal is that users also get to store their store loyalty cards within the app. This means they can get rewarded for shopping on their favorite platforms.

If you are thinking of holding a fundraiser, think of PayPal. The platform makes it easy to organize and receive donations for whatever legal purpose. It doesn’t charge any fee for using the ‘Giving Fund’ page feature to raise money.

Supports International Money Transfers

PayPal is available in over 200 countries all over the world making the need to send money abroad easy. Just ensure you make adequate provisions for the charges attached to such transactions.

Users can also hold multiple currencies in a single PayPal account, send and receive payments in other currencies as well as convert their PayPal balance to another currency. This flexibility allows for seamless international transactions with been able to leverage the best deals available. Irrespective of your current location and currency!

Safe PLATFORM

PayPal is known for the safety and security of transactions made on its platform either the web or the app. The platform doesn’t share its user’s financial data when they make purchases or transfer funds to friends and families.

Additionally, its protection policies expressly cover its users when they are buying or selling products online. Should a buyer not receive a product or service purchased via PayPal, the platform gets you your money back.

sUPPORTS Multiple payment methods

When we said the platform was easy to use, we didn’t mention the funding payment method. The PayPal platform allows users to fund their transactions online through various means.

So a user can decide to use any of the following such as bank account, debit card, credit card, or PayPal balance. Whichever method is convenient for the user is available and they are not restricted to one way. The only catch here is that some methods such as credit cards have charge fees associated with them.

Why Cancel Pending PayPal Payment

It’s important to keep in mind that not all payments can be canceled upon submission, but under a number of circumstances, it is possible to cancel pending PayPal payments.

Like we’ve established before, there is a multitude of reasons a user might want to cancel a PayPal payment. Let’s consider some of the instances where it might be necessary to cancel pending PayPal payments.

- A user might need to cancel a payment on PayPal if payment was sent from his PayPal account to the wrong address.

- When a user has made a payment into the right account but has entered the wrong or incorrect amount.

- The sender can cancel pending PayPal payment if he and the buyer are unable to agree on terms after the sender has made payment.

- When a recipient fails to claim the sent payment for a period of time

- Or simply due to the sender having a change of heart or being remorseful.

If you find yourself with one of the aforementioned instances, canceling the payment becomes necessary and must be done as quickly as possible. Why? If the payment is still pending, then it is possible to cancel such payment. With that, the option to cancel the payment is available and a refund is made without any associated charges. But if marked as “completed”, it becomes much more complex and only a direct appeal to the receiver can get your money back.

“Claimed” PayPal Payment

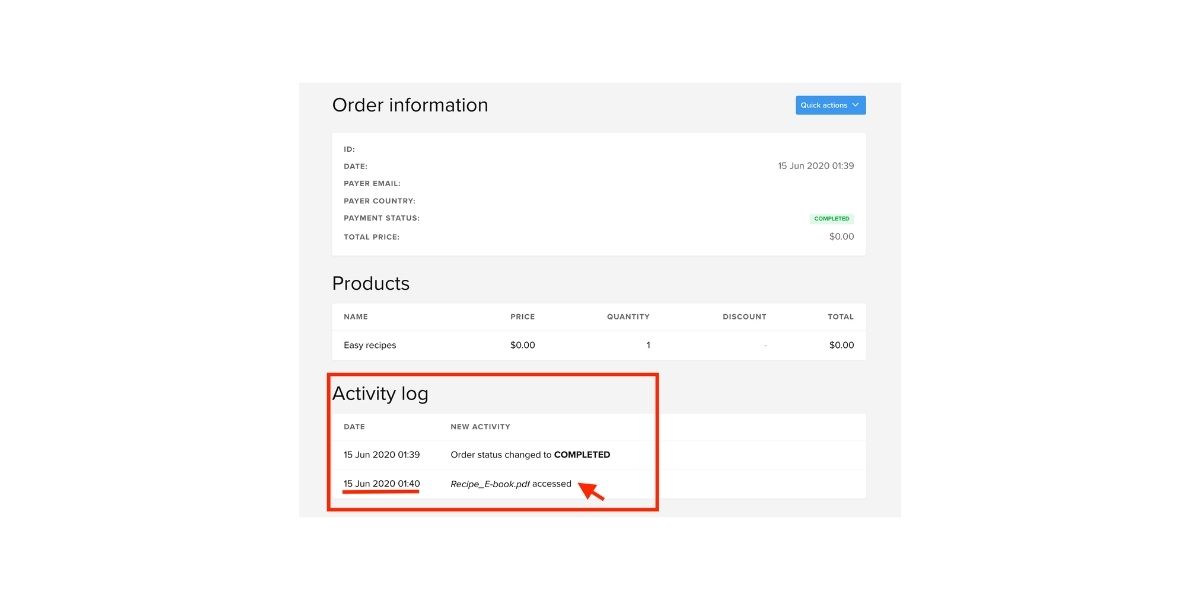

If as a user, you have any reason to cancel pending PayPal payment, you have to do so before the payment is claimed. Else, your fund is sent successfully and can’t be recovered by PayPal. Thankfully, it’s easy to know if a payment has been claimed or not.

Simply navigate through the PayPal platform to the specific payment. Once there, any unclaimed payment will have the option ‘cancel’ within its “action column”. Click on that and verify that you want to cancel such a payment.

In the instance of funds sent to a non-existent PayPal email address. Even if the sender is unaware, the funds will be remitted back to the sender after a certain period of time.

How to Cancel Pending PayPal payment

To cancel a PayPal payment is pretty much easy and straightforward. Simply follow the steps below to effect the cancelation and have the payment returned to your account.

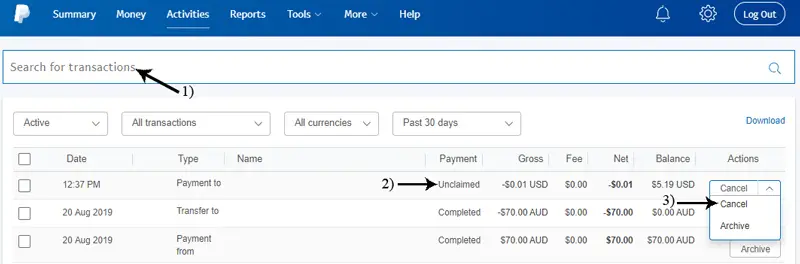

- Log in to your ‘PayPal’ account and click on the ‘Activities’ button.

- This displays a list of all the recent transactions. A user has to then navigate to the payment he or she wishes to cancel using email, name, or other means.

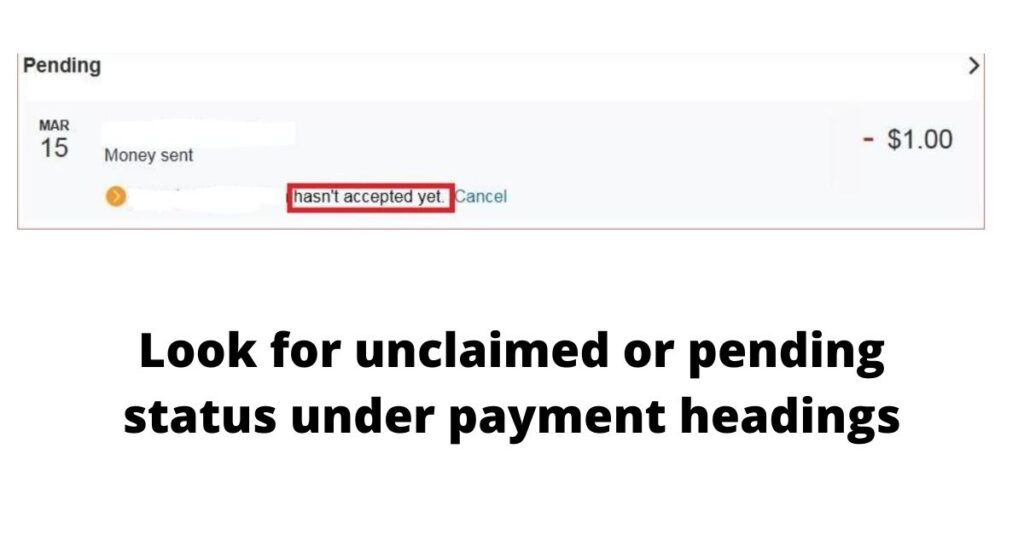

- Upon locating the payment, check the payment status and ensure it’s still a pending transaction. You can do this via the ‘Actions column’. If the payment is pending a ‘Cancel’ button will appear just below it.

- To proceed to cancel an unclaimed transaction, simply click the ‘Cancel’ button.

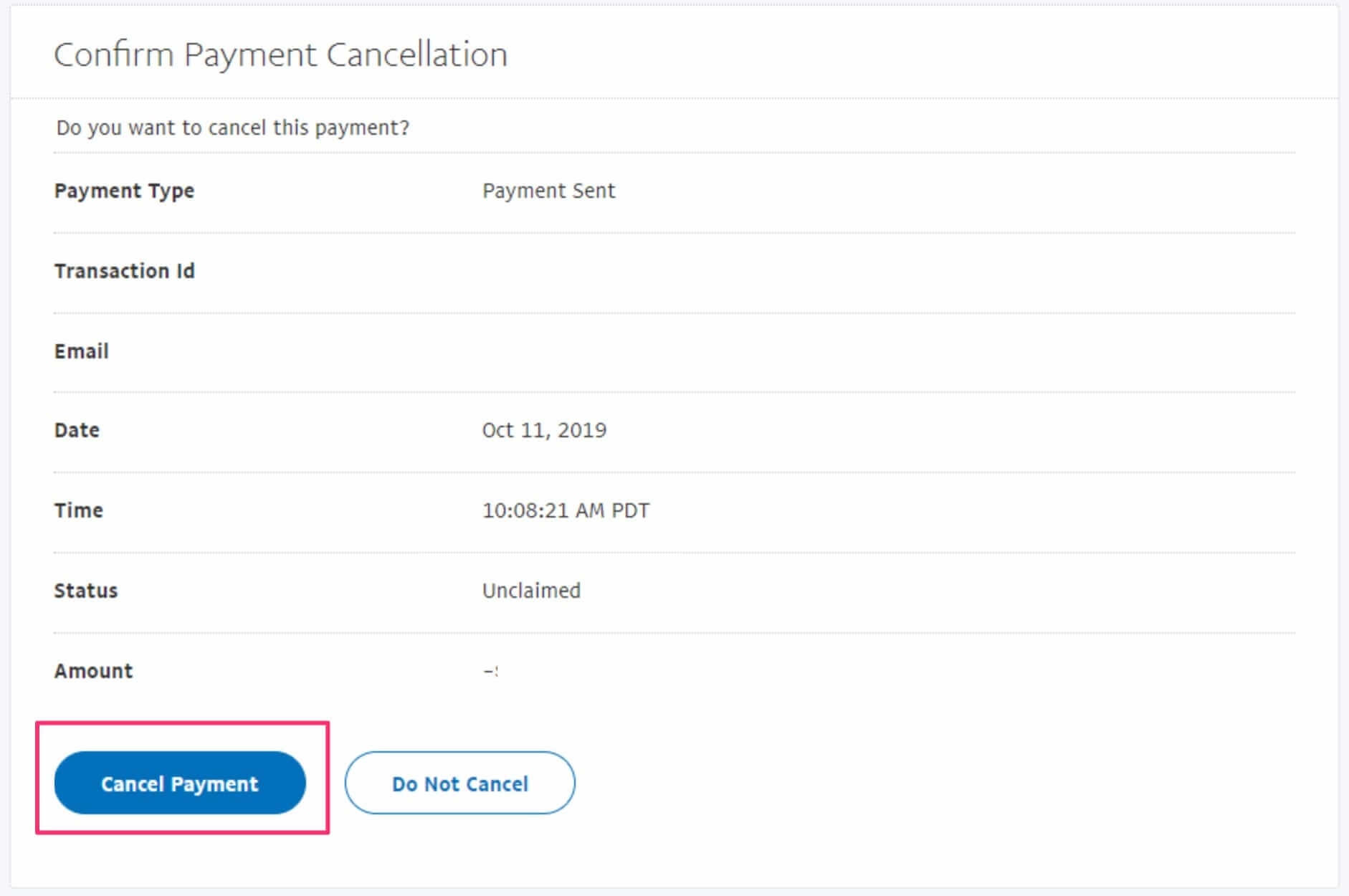

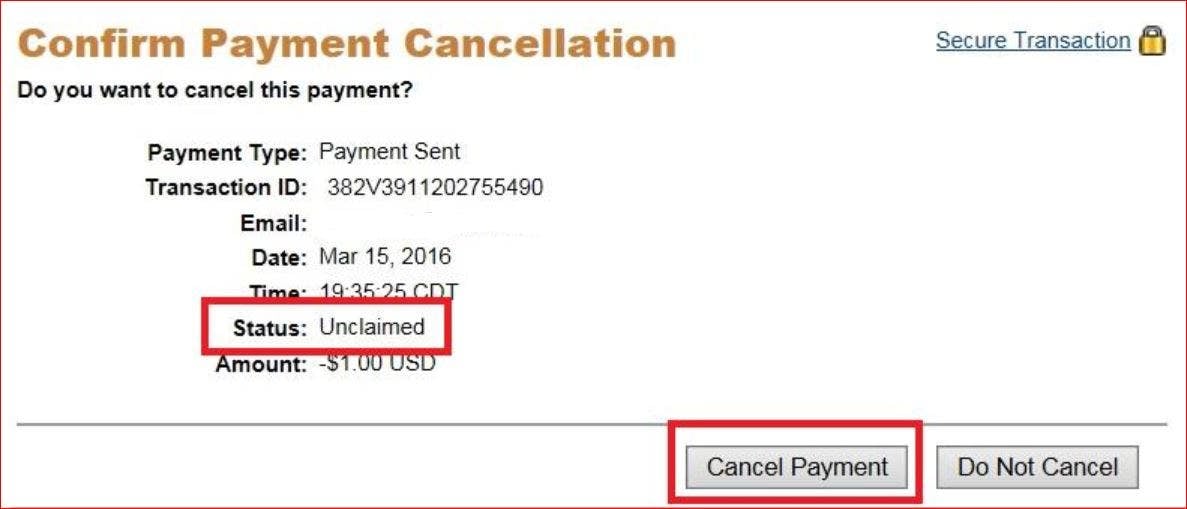

- A notification prompt comes up asking the user to confirm the cancellation of the payment before continuing. At this point, a user can select the ‘Do Not Cancel’ option if they change their mind to go through with the payment. To cancel the payment, just click on ‘Cancel Payment’ to proceed.

- Upon successful cancellation, the user is notified in the next dialog box that appears.

Note: please keep in mind that if you cancel a PayPal payment made with a credit card; it can take up to 30 days before the refund gets to your credit card account. This means processing is not immediate for canceling payments made via credit card.

Immediately after a user successfully cancels a pending PayPal payment, the funds return into the user’s PayPal account. This is regardless of whether the original payment was made via bank funds or PayPal funds. Always expect some form of delays sometimes but the return of funds shouldn’t exceed four working days.

How businesses can receive Online Payments via PayPal

The most popular aspect of the PayPal service portfolio is PayPal online payments. This is because many of its users use the platform to send or receive money globally. There are basically three methods of receiving money via credit and bank transfers on PayPal. These include the PayPal Checkout (Formerly Express Checkout), Payments Pro, and Payments Standard.

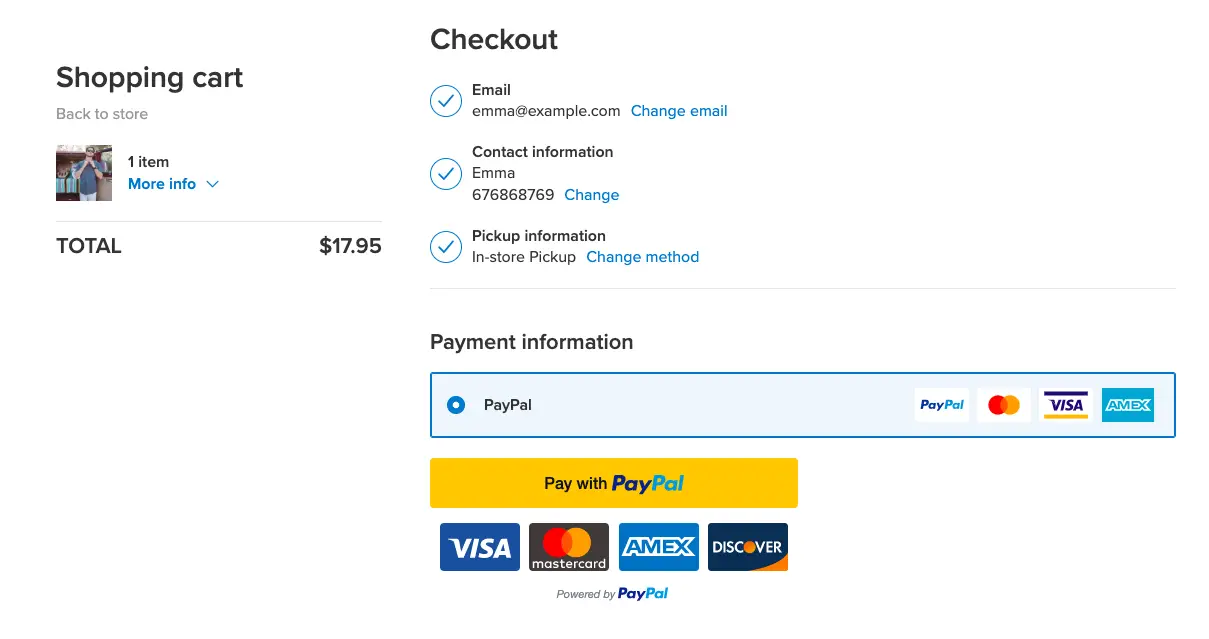

PayPal Checkout

This has to be the most basic option. Businesses simply add a button to their existing website or eCommerce platform. By doing so, businesses obtain access to PayPal technology to perform functions like credit card information and currency processing.

Sometimes, this might require a bit of technical know-how or you can simply outsource to a developer to help fully implement the checkout procedure with your website. But PayPal will handle aspects such as maintenance and PCI compliance for the business. PCI simply means that PayPal routes customers back to its website to complete a purchase.

Checkout comes with features like:

- Backend maintenance and security: PayPal handles the entire necessary workload concerning the back-end handlings for a business. This allows businesses to focus more on growing their brand as well as revenue.

- Contextual checkout buttons: PayPal serves up smarter checkout buttons. The designs of these buttons allow it to care for the needs of potential clients. This creates a superb opportunity for businesses with an interest in contextual commerce.

- Localized payment methods: PayPal is continuously searching for innovative ways to stay ahead of the completion. The platform is rapidly rolling out new localized payment methods for customers around Europe as well as other parts of the world.

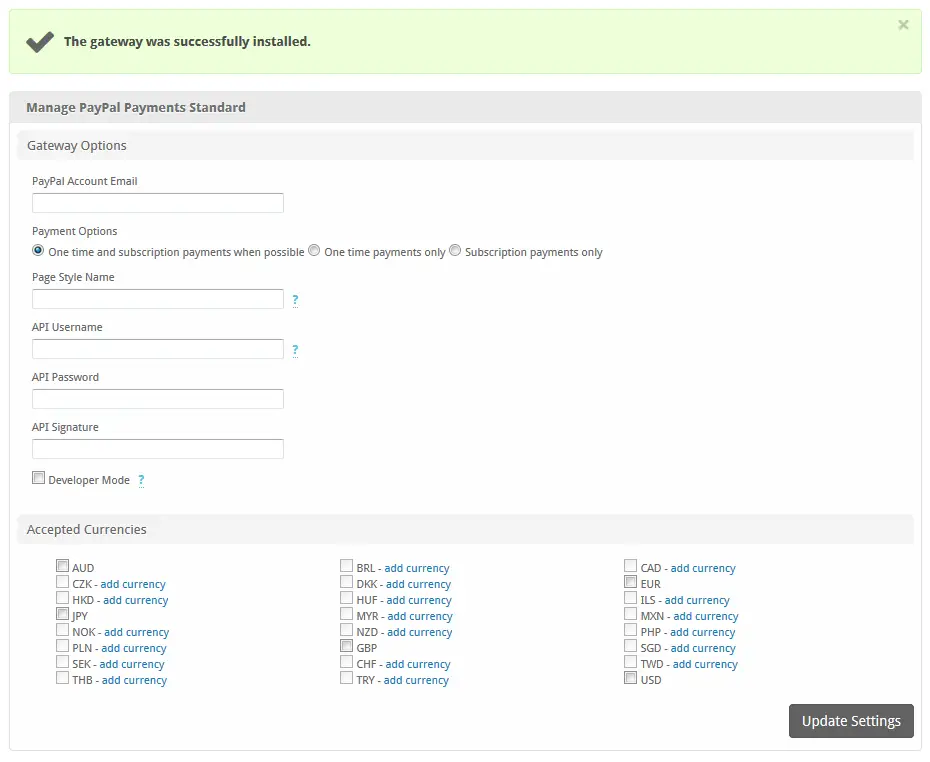

PayPal Payments Standard

This is a little more complex than the basic checkout feature. The PayPal payments standard provides business owners with more control of their payment processes as well as customization techniques. It comprises all the features available in PayPal Checkout with the exception of the smart checkout button.

The available customization elements allow users to adjust the look and feel of their checkout process. Also, businesses can create an online shop that allows them to sell as many products as they can afford according to their requirements. PayPal payment standard also comes with PCI compliance just like its regular Checkout feature.

PayPal Payments Pro

This is the most advanced payment solution option on PayPal. Users who have access to developer guidance and support can easily utilize this feature. Also, businesses that want to exercise greater control over their payment strategy for customers can leverage PayPal Payments Pro as it provides the most customizable service.

Potential clients looking to make a purchase will have access to a checkout page with its own separate hosting. This stops the usual sending of users to another website whenever they about to make a purchase. Also, they will still get to enjoy the same level of security and buyer protection they would from PayPal.

Payments Pro also provides access to another add-on tool for recurring billing, but this will be at a cost to the business. PayPal Payments Pro also ensures that it is easier for businesses to accept payments over the phone with virtual terminal payments.

Conclusion

PayPal offers a convenient medium for completing a business or leisure transaction online. It also offers a simple way to cancel pending PayPal payments if and when an error occurs. Users can simply follow the above steps to cancel any pending PayPal payment before the recipient claims it.