PayPal is mostly known for its online payments and oftentimes; users can ask, how do I cancel a payment o PayPal? Users should know that it is possible to cancel payments on the platform and we intend to show you how to do just that. A lot of individuals simply assume that the platform is a simple payment method for online shopping but there’s more to PayPal.

PayPal’s portfolio contains an extensive combination of impressive features meant to make the process of doing business easy both online and offline. The platform is essentially a complete third-party payment processor and service provider.

PayPal is certainly an awesome choice for people looking to utilize a secure, easy-to-use platform either for personal or business purposes. It’s popular also quite popular among businesses with an online presence as well as international payment receivers. In like manner, the platform leaves room for its users to cancel a payment they’ve made. Users can cancel recurring or subscription payments as well as one-time payment that is yet to be claimed by the recipient.

In this article, we at Daniel’s Hustle are going to examine in detail, a full guide on how to cancel a payment on PayPal.

When Can I Cancel a PayPal Payment?

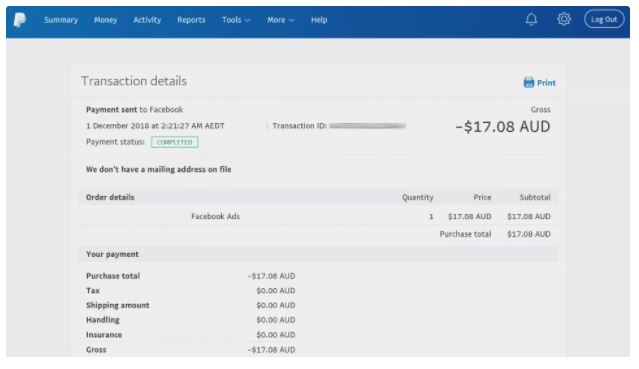

Unfortunately, you can’t reverse or cancel a PayPal transaction that’s been completed. Payment can only be canceled if it’s marked as Pending or Unclaimed on its Transaction details page.

If you can’t initiate a PayPal payment cancellation, you need to personally get in touch with the recipient and ask them to refund your payment. The easiest way to do this is to email them using the address associated with their PayPal account. The last resort should be to file a dispute via the PayPal Resolution Center.

Why Cancel a Payment on PayPal?

It’s important to keep in mind that not all payments can be canceled upon submission, but under a number of circumstances, it is possible to cancel a PayPal payment.

Like we’ve established before, there is a multitude of reasons a user might want to cancel a PayPal payment. Let’s consider some of the instances where it might be necessary to cancel a PayPal payment.

- A user might need to cancel a payment on PayPal if payment was sent from his PayPal account to the wrong address.

- When a user has made a payment into the right account but has entered the wrong or incorrect amount.

- The sender can cancel a payment on PayPal if he and the buyer are unable to agree on terms after the sender has made payment.

- When a recipient fails to claim the sent payment for a period of time

- Or simply due to the sender having a change of heart or being remorseful.

Admittedly, we are prone to any of the above instances befalling us and it is imperative to take action as quickly as possible. Why? If the tendered payment is yet to be ‘claimed’, then it is possible to cancel such payment. This is often true if the PayPal email the money was sent to doesn’t exist. With that, the option to cancel the payment is available and a refund is made without any associated charges.

Also, if an account holder is yet to confirm their PayPal email address, a sender can cancel a payment on PayPal made. Unfortunately, if the said payment has been claimed, the only way of receiving the payment back is to contact the account holder and request a refund.

How to know if a payment on PayPal has been claimed

If a user has any reason to cancel a payment on PayPal, they have to perform the cancelation before the payment is claimed. Else, such funds sent successfully can’t be recovered directly via PayPal.

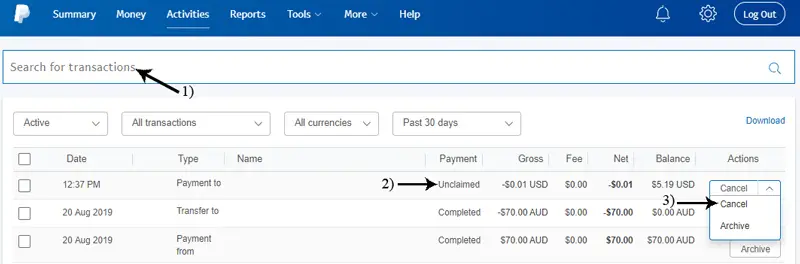

We’ve explained how a user can get to know if a payment is still available for cancelation. All the user has to do is to navigate through the PayPal platform to the specific payment. Once there, any unclaimed payment will have the option ‘cancel’ within its “action column”. Simply click on that and verify that you want to cancel such a payment.

In the instance of funds sent to a non-existent PayPal email address. Even if the sender is unaware, the funds will be remitted back to the sender after a specific duration.

How to cancel a payment on PayPal

To cancel a payment on PayPal is pretty much easy and straightforward. Simply follow the steps below to effect the cancelation and have the payment returned to your account.

- Log in to your ‘PayPal’ account and click on the ‘Activities’ button.

- A list of all the recent transactions is displayed. A user has to then navigate to the payment he or she wishes to cancel using email, name, or other means.

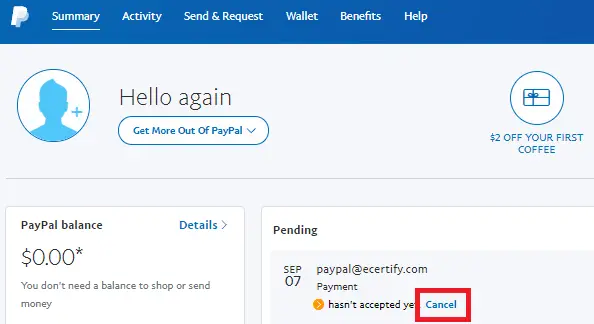

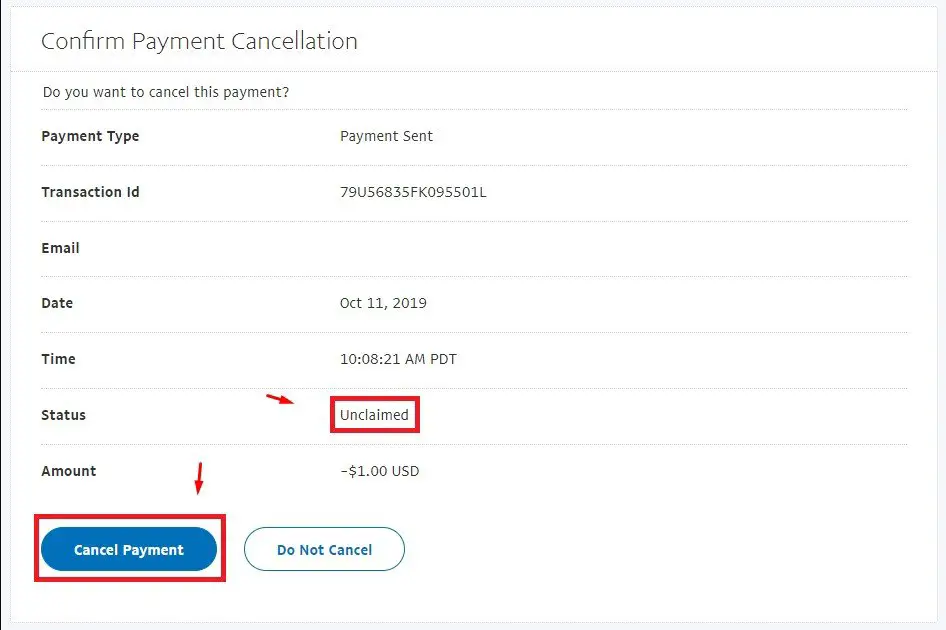

- Upon locating the payment, check if it’s unclaimed or still a pending transaction. You can do this via the ‘Actions column’. If the payment can be canceled, a ‘Cancel’ button will be displayed just below it. If the cancel option is not displayed, that means that the payment has been completed. The user will have to request a refund from the account holder.

- To proceed to cancel an unclaimed transaction, simply click the ‘Cancel’ button.

- You will be prompted to confirm the cancellation of the payment before continuing. At this point, a user can select the ‘Do Not Cancel’ option if they change their mind to go through with the payment. To cancel the payment, just click on ‘Cancel Payment’ to proceed.

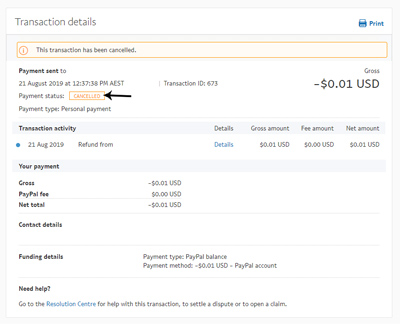

- Upon successful cancellation, the user is notified in the next dialog box that appears.

Immediately after a user successfully cancels a PayPal payment, the funds are restored back into the user’s PayPal account. This is regardless of whether the original payment was made via bank funds or PayPal funds.

Although there can sometimes be a delay the return of funds shouldn’t exceed four working days.

Why cancel a recurring payment or subscription through PayPal?

If a user chooses to cancel a recurring payment or subscription on PayPal, it can be for many reasons. Whatever the reasons might be, a user can put a stop to it through PayPal by following simple steps to stop further charges on their account:

- If the content provided by the subscription is not what they were expecting. A user might actually at the point of subscription be getting the needed information, it’s easy to lose them along the line. When this happens, a user feels the need to cancel the subscription.

- A user can cancel a recurring payment through PayPal if they are not seeing value for the money paid. If the services or product paid for is subpar, they can choose to cancel.

- Ultimately users cancel a recurring payment through PayPal if and when they find themselves in a declining financial situation. This effectively makes it difficult to keep up with the payment obligations and as such, they decide to cancel.

- If a user is changing his or her location, chances are they will cancel a recurring payment. This becomes necessary if the service is not been offered in the location they are heading to.

- This is another major reason users cancel recurring. A user might have over time lost interest in the activity that a subscription offers and as such sees no reason to keep paying for it.

- No doubt, the level of competition is increasing daily. Newer platforms are looking for customers and are always eager to churn out impressive deals. Most times, they refer to lowering the price tag to attract customers. A user can decide to end their subscription and move to the more favorable one.

How to cancel a recurring payment or subscription through PayPal?

To cancel a recurring payment via PayPal is quite simple, easy, and straightforward. Simply follow the steps below to achieve this:

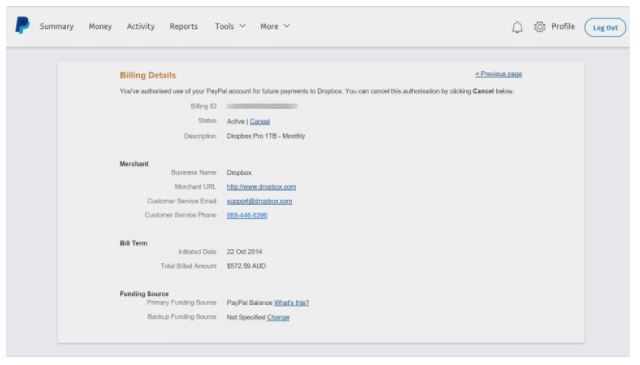

- Login in to your PayPal account that houses the subscription plan.

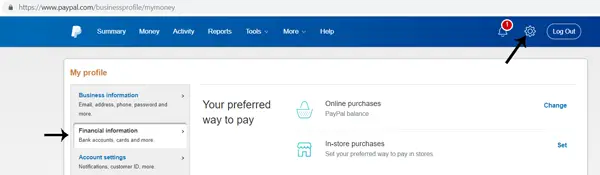

Click on the ‘cog’ icon. Then proceed to select the ‘Financial Information’ menu. - Scroll to and click on the ‘Manage Automatic Payments’ button. This is just below the ‘Automatic Payments’ section.

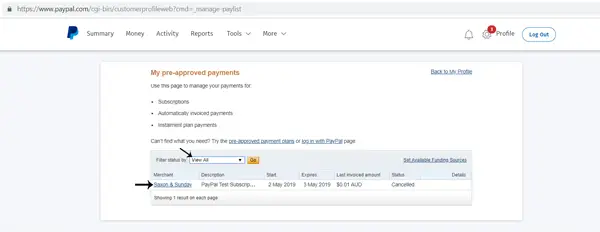

This displays all your recurring payments. Select the ‘Merchant’ name for the payments you wish to cancel. - A ‘Cancel’ button is displayed right above the transaction details. Click this button.

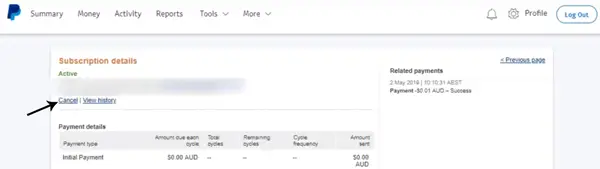

- A cancellation confirmation prompt is displayed and you have to confirm your cancelation action.

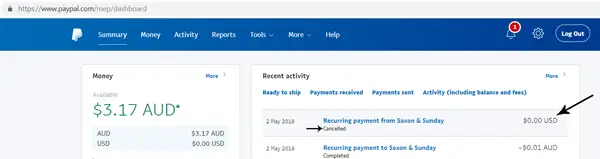

- Upon successful cancellation of the recurring payment, a record of the cancellation is made under your ‘Recent Activity’.

If you follow the above steps accordingly, you will have successfully canceled such recurring payments through your PayPal account.

Pros of using PayPal

- PayPal is one of the most trusted third-party payment platforms by users all around the world. This effectively makes it one of the most popular ways to make a payment online.

- The platform has predictable pricing with flat rates to suit the individual budgets as well as various pricing plans available.

- It supports selling via subscriptions and recurring payments with lots of different currencies for international transactions

- Great developer tools for integrations and growth as well as extensive integrations with numerous eCommerce tools and platforms.

- The platform can be used as an all-in-one payment system which is ideal for low volume merchants who don’t take too many payments.

- Compatible with many mobile device platforms as well as accounting and financial tools.

- PayPal also provides hardware and card readers for its users

- For businesses, the option for borrowing money and capital is a welcome addition endearing the platform to many

Cons of using PayPal

- PayPal users often complain about the platform’s lack of consistent customer support.

- When you transfer money from your PayPal account to your bank account, you have two options: A free transfer; which often takes one to five business days or a paid instant transfer. The instant transfer often takes one business day to process, but there’s no guarantee.

- PayPal does set limits for unverified users. Limits are dependent on currencies but generally in the range of $10,000 in one transaction, with a cap of $60,000.

- PayPal is a popular platform and it’s often a target for phishing scams. Unsuspecting users can fall prey to these scams when they receive and open fake emails that contain phishing links. Be aware of this when opening any email or PayPal link.

- Not suitable for higher-risk industries and lots of users have mentioned a sudden shut down of their account.

Conclusion

PayPal offers a flexible way of making both domestic and international transactions online without stress. The platform is fast, stable, and reliable and has been around for years, so they have experience in the field of handling third-party payments.

PayPal is quite popular among merchant sites as well as personal users. Should a user decide to want to cancel a payment transaction for whatever reason, the platform offers ample time to take such action. It should be noted that a completed transaction can’t be canceled directly from PayPal. In such instances, seeking a refund by directly appealing to the receiver of such payment is best. In some cases contacting the PayPal Resolution Center could be of help.

To cancel pending or recurring payments on the platform is very easy. Simply follow the guides provided above to help you achieve this.