PayPal offers individuals and businesses alike the avenue to make and receive payments from customers but sometimes, the need to cancel a PayPal payment arises. The platform is also used to transact business with suppliers, vendors, as well as send payments for essential services.

PayPal is a handy tool for sending and receiving payments online from both domestic and international sources. Your friends, family, clients, and customers can easily leverage the platform to get funds across to you with ease.

With PayPal’s recent entry into the world of business financing, the company increased its value to people who run their own businesses. Occasionally, the need to cancel a PayPal payment can occur due to a change of heart, wrong amount, or error while inputting receiver details.

In times like that, users may probably wonder; is it possible to cancel a PayPal payment. To be able to effectively cancel a PayPal payment, the transaction must be in “Pending” or “Unclaimed” status.

In this article, we will look to explain in detail how to cancel a PayPal payment easily.

How PayPal works?

PayPal is an easy-to-use payments platform with a large variety of awesome features. The platform ensures it’s easy to make payments to friends and family as well as pay for goods and services. It requires the user to set up an account on the platform. Once that is done, they can leverage the platform via its app or a web browser to manage numerous transactions of varying degrees.

For a user to send, receive, or request money to or from anyone with a PayPal account, they will require any of the following data:

- PayPal username

- Mobile phone number

- Email address

- Me link (your personal payment link)

- Personal QR code

Many users have found that utilizing PayPal.Me link and QR functionality help minimize the risk of mistyping errors. Since it doesn’t require them to type in a receiver’s information directly and saves time as well. This reduces the need to cancel a PayPal payment noticeably. All that they need to do is to click the link or scan the QR code.

The PayPal app also lets you keep track of your spending, and split bills with your friends. You can easily use this app in both your personal and professional life. It’s worth noting that you’ll have to pay fees for certain PayPal functions

Why Cancel a Payment on PayPal

It’s important to keep in mind that not all payments can be canceled upon submission, but under a number of circumstances, it is possible to cancel a PayPal payment.

Like we’ve established before, there is a multitude of reasons a user might want to cancel a PayPal payment. Let’s consider some of the instances where it might be necessary to cancel a PayPal payment.

- A user might need to cancel a PayPal payment if payment was sent from his PayPal account to the wrong address.

- When a user has made a payment into the right account but has entered the wrong or incorrect amount.

- The sender can cancel a PayPal payment if he and the buyer are unable to agree to terms after the sender has made payment.

- When a recipient fails to claim the sent payment for a period of time

- Or simply due to the sender having a change of heart or being remorseful.

Admittedly, we are prone to any of the above instances befalling us and it is imperative to take action as quickly as possible. Why? If the tendered payment is yet to be ‘claimed’, then it is possible to cancel such payment. This is often true if the PayPal email the money was sent to is not in existence. With that, the option to cancel the payment is available and a refund is made without any associated charges.

Also, if an account holder is yet to confirm their PayPal email address, a sender can cancel a PayPal payment made. Unfortunately, if the said payment has been claimed, the only way of receiving the payment back is to contact the account holder and request a refund.

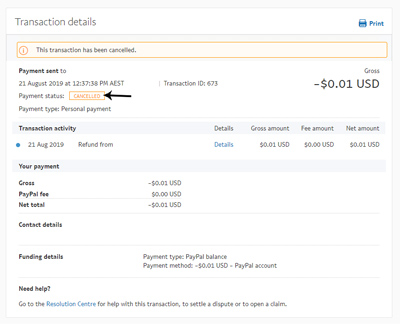

How to Know a Claimed PayPal Payment

If as a user, you have any reason to cancel a PayPal payment, you have to do it before the payment is claimed. Else, your fund is sent successfully and can’t be recovered by PayPal.

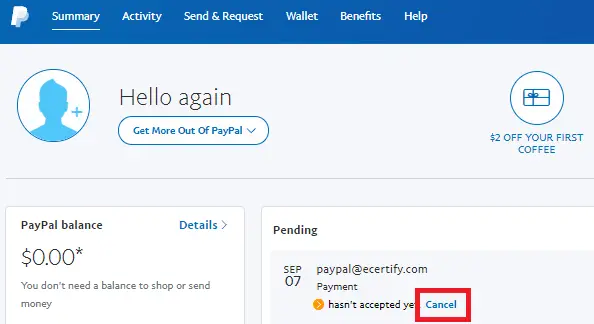

To know if a payment has been claimed or not is a simple and easy task to accomplish. All the user has to do is to navigate through the PayPal platform to the specific payment. Once there, any unclaimed payment will have the option ‘cancel’ within its “action column”. Simply click on that and verify that you want to cancel such a payment.

In the instance of funds sent to a non-existent PayPal email address. Even if the sender is unaware, the funds will be remitted back to the sender after a certain duration.

How to Cancel a PayPal payment

To cancel a PayPal payment is pretty much easy and straightforward. Simply follow the steps below to effect the cancelation and have the payment returned to your account.

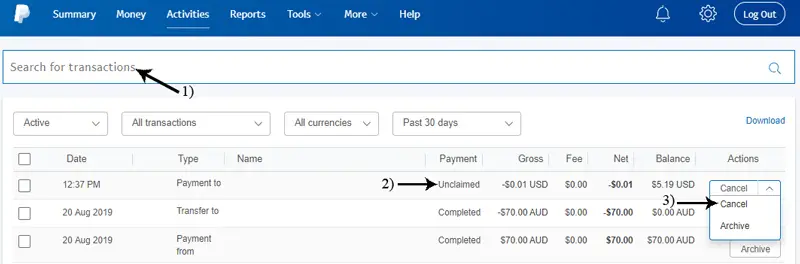

- Log in to your ‘PayPal’ account and click on the ‘Activities’ button.

- A list of all the recent transactions is displayed. A user has to then navigate to the payment he or she wishes to cancel using email, name, or other means.

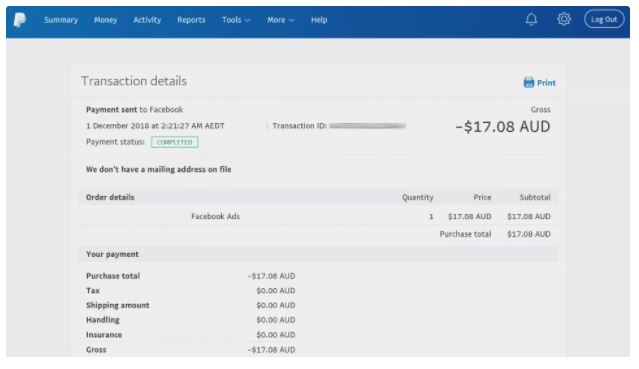

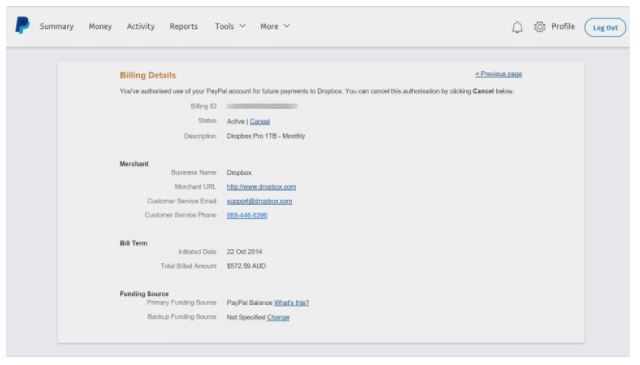

- Upon locating the payment, check if it’s unclaimed or still a pending transaction. You can do this via the ‘Actions column’. If the payment can be canceled, a ‘Cancel’ button will be displayed just below it. If the cancel option is not displayed, that means that the payment has been completed. Users will have to request a refund from the account holder.

- To proceed to cancel an unclaimed transaction, simply click the ‘Cancel’ button.

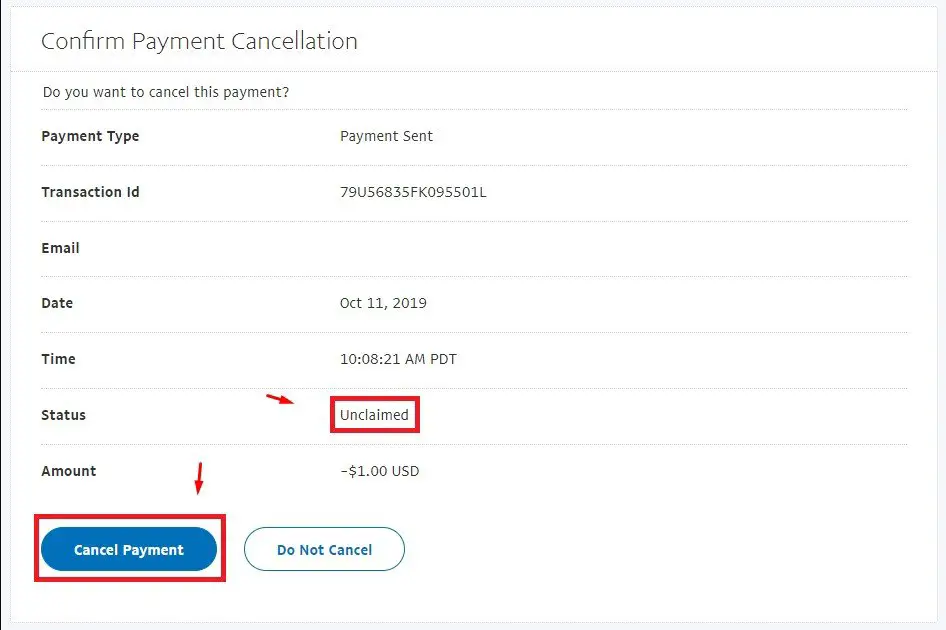

- You will be prompted to confirm the cancellation of the payment before continuing. At this point, a user can select the ‘Do Not Cancel’ option if they change their mind to go through with the payment. To cancel the payment, just click on ‘Cancel Payment’ to proceed.

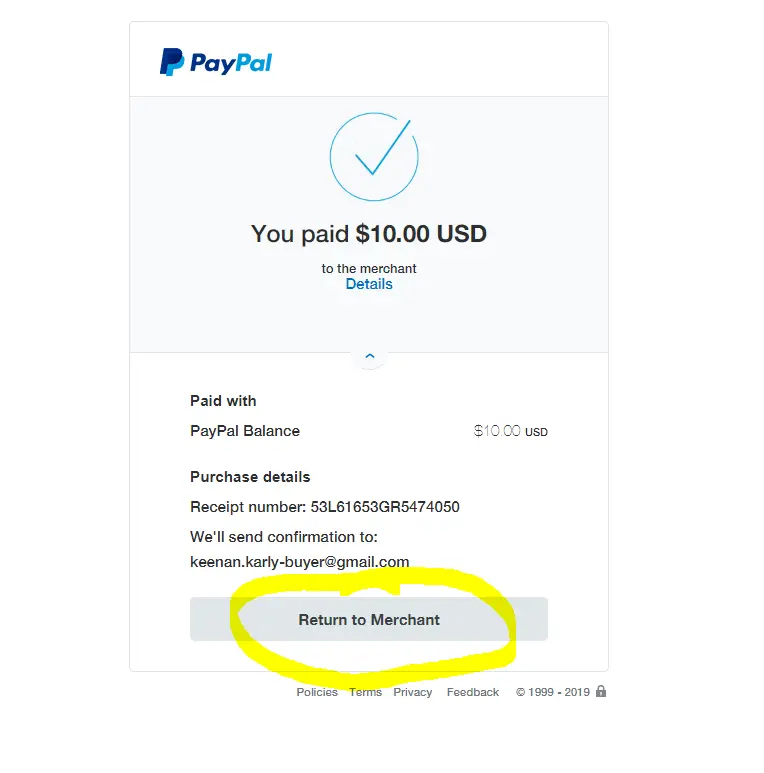

- Upon successful cancellation, the user is notified in the next dialog box that appears.

Note: please keep in mind that if you cancel a PayPal payment made with a credit card; it can take up to 30 days to get refunded to your credit card account. This means refunds are not processed immediately for canceling payments made by credit card.

What next after cancellation?

Immediately after a user successfully cancels a PayPal payment, the funds are restored back into the user’s PayPal account. This is regardless of whether the original payment was made via bank funds or PayPal funds.

Although there can sometimes be a delay the return of funds shouldn’t exceed four working days.

What are the costs?

It’s free to send money to friends and family via a debit card, bank account, or PayPal balance. Otherwise, there are fees associated with certain actions. These fees are outlined previously in our review.

Domestic and international fees

| TRANSACTION TYPE | DOMESTIC | INTERNATIONAL |

| PayPal balance, bank account, or Amex Send account | Free | 5% |

| Credit card | 2.9% + $0.30 ($0.99 minimum, $4.99 maximum) | 7.9% + fixed fee ($0.99 minimum, $4.99 maximum) |

Transferring money out of PayPal

| TRANSFER TYPE | COST | MAXIMUM FEE |

| Local bank account | No fee | — |

| Instant bank account transfer | 1% of the transfer amount | $10 maximum fee in USD |

| Instant transfer to cards | 1% | $10 maximum fee in USD |

| Paper check mailed to you | $1.50 | — |

Receiving payment via QR Code

| TRANSACTION AMOUNT | DOMESTIC | INTERNATIONAL |

| Transactions above $10 | 1.9% + $0.10 | 1.9% + fixed fee + 1.5% |

| Transactions of $10 and below | 2.4% + $0.05 | 2.4% + fixed fee + 1.5% |

Fixed fees vary by currency and commercial-based QR code payments have higher fixed fees. Check out PayPal’s website for full details.

Pros of using PayPal

- PayPal is one of the most trusted third-party payment platforms by users all around the world. This effectively makes it one of the most popular ways to make a payment online.

- The platform has predictable pricing with flat rates to suit the individual budgets as well as various pricing plans available.

- It supports selling via subscriptions and recurring payments with lots of different currencies for international transactions

- Great developer tools for integrations and growth as well as extensive integrations with numerous eCommerce tools and platforms.

- The platform can be used as an all-in-one payment system which is ideal for low volume merchants who don’t take too many payments.

- Compatible with many mobile device platforms as well as accounting and financial tools.

- PayPal also provides hardware and card readers for its users

- For businesses, the option for borrowing money and capital is a welcome addition endearing the platform to many

Cons of using PayPal

- PayPal users often complain about the platform’s lack of consistent customer support.

- When you transfer money from your PayPal account to your bank account, you have two options: A free transfer; which often takes one to five business days or a paid instant transfer. The payment via transfer often takes one business day to process, but there’s no guarantee.

- PayPal does set limits for unverified users. Limits are dependent on currencies but generally in the range of $10,000 in one transaction, with a cap of $60,000.

- PayPal is a popular platform and it’s often a target for phishing scams. Unsuspecting users can fall prey to these scams when they receive and open fake emails that contain phishing links. Be aware of this when opening any email or PayPal link.

- Not suitable for higher-risk industries and lots of users have mentioned a sudden shut down of their account.

Conclusion

PayPal is a convenient way of making payments and completing a business or leisure transaction. It also offers a simple way to cancel a PayPal payment if and when an error occurs. By following the above steps, we are sure you now know how to cancel a PayPal payment before the recipient claims it.